View Procedure

| Procedure Name | Customs Clearance procedure for Import for Home Consumption |

|---|

| Description |

|

Category

|

Clearance

|

|

Responsible Agency

|

Name of Agency; Lesotho Revenue Authority

Address: Finance House Building, Kingsway Road, Maseru

Phone: 223 13796

Fax: 223 12091

Email: enquiries@lra.org.ls

Official Website: www.lra.org.ls

|

|

Legal base of the Procedure

|

Customs and Excise Act No. 10, 1982 |

|

Fee

|

|

Required Documents

|

No.

|

Type of information

|

Note

|

|

1

|

IM4 declaration |

|

Pre-arrival information can be any of the following:

|

No.

|

Type of information

|

Note

|

|

1

|

Commercial documents from the Supplier which may include but not limited to Invoices, Transport documents, Parking lists etc..

|

Documents necessary for the Declaration

|

|

2

|

Import permits or certificates from the Country of Export or Origin

|

|

3

|

Authority letter from Importer appointing a clearing agent to clear the goods on his behalf

|

|

4

|

Import permits for specific goods in accordance with the current Trade regulations, obtained from One-Stop Business Facilitation Centre (OBFC) or the various relevant Government Ministries

|

|

5

|

Rebate and Exemption certificates from OBFC

|

If applicable

|

|

6

|

Manifests from Aircraft and other means of transport reporting arrival to Customs at a port of entry

|

|

|

7

|

Advance declaration data from other Customs administrations

|

|

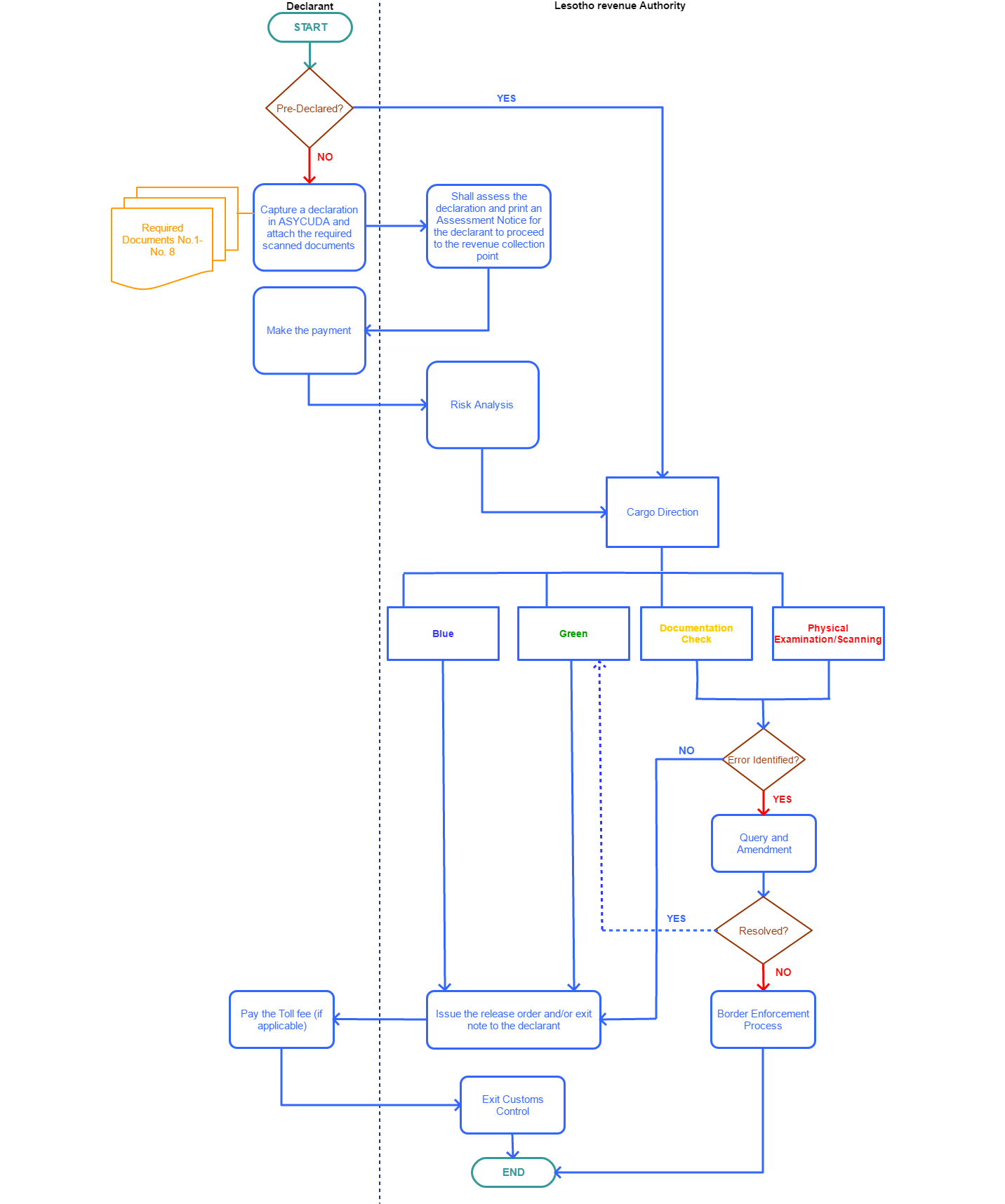

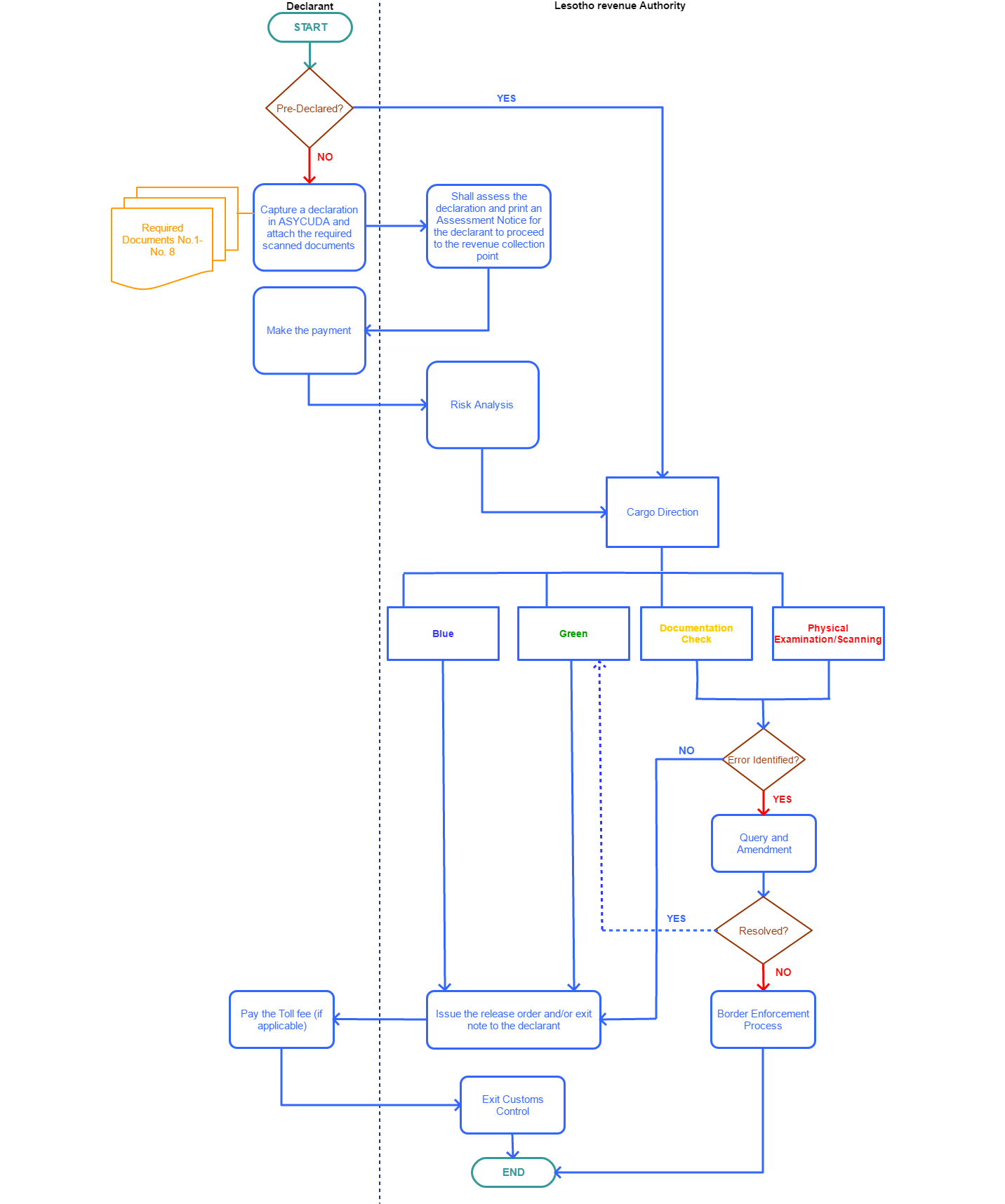

Process Steps

|

Step1

|

Capture and assess a declaration in ASYCUDA and attach the required scanned documents to the declaration taking special care to choose the correct Customs regime

|

|

Step2

|

Customs Data Capture officer shall Assess the declaration and print an Assessment Notice for the declarant to proceed to the revenue collection point

|

|

Step3

|

The Declarant make the payment

|

|

Step4

|

Customs Officer advise the declarant whether the cargo is ready for release or if it’s being subjected to the risk management process

Where goods are to be subjected to physical examination or documentary check, advise the declarant which process step he should report to and the process under those respective sections will proceed as required.

|

|

Step5

|

Release

For goods ready for release, print the release order and/or the Exit note (depending on the border office structure) and issue it to the declarant to exit Customs control.

|

| Step6 |

Exit

Receive the release order from the declarant and confirm its authenticity in the system. If approved, Create and print an exit note in ASYCUDA.

Give the exit note to the declarant to allow him/her proceed to Toll fees if necessary.

|

| Step7 |

Road Fund (Toll fees) facility receive the exit Note from the declarant and determine how much Toll fees to collect

|

| Step8 |

Declarant pays the Fees

|

| Step9 |

Road Fund (Toll fees) facility Issue a receipt as proof of payment

|

| Step10 |

Allow the declarant to Exit out of Customs control |

|

|---|

| Category | Procedures |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| Customs Clearance requirements for Import for Home Consumption | General | | When goods are cleared from the custom station, they ceased to be imported goods for the purpose of Customs Act | On arrival of the cargo at the Customs Port of entry, the declarant will report to the Customs officer at the entrance gate for confirmation of arrival details to be recorded and be advised of the next course of action | Customs and Excise Act No. 10, 1982 | 31-12-9999 | Good |

115