View Procedure

| Procedure Name | Permanent Export for Intra-SACU goods |

|---|

| Description |

|

Category

|

Clearance

|

|

Responsible Agency

|

Name of Agency; Lesotho Revenue Authority

Address: Finance House Building, Kingsway Road, Maseru

Phone: 223 13796

Fax: 223 12091

Email: enquiries@lra.org.ls

Official Website: www.lra.org.ls

|

|

Legal base of the Procedure

|

Customs and Excise Act No. 10, 1982 |

|

Fee

|

|

Required Documents

|

No.

|

Type of information

|

Note

|

|

1

|

EX1 declaration |

|

Pre-arrival information can be any of the following:

|

No.

|

Type of information

|

Note

|

|

1

|

Commercial documents from the Supplier which may include but not limited to Invoices, Transport documents, Parking lists etc..

|

Documents necessary for the Declaration

|

|

2

|

Import permits or certificates from the Country of Export or Origin

|

|

3

|

Authority letter from Importer appointing a clearing agent to clear the goods on his behalf

|

|

4

|

Import permits for specific goods in accordance with the current Trade regulations, obtained from One-Stop Business Facilitation Centre (OBFC) or the various relevant Government Ministries

|

|

5

|

Rebate and Exemption certificates from OBFC

|

If applicable

|

|

6

|

Manifests from Aircraft and other means of transport reporting arrival to Customs at a port of entry

|

|

|

7

|

Advance declaration data from other Customs administrations

|

|

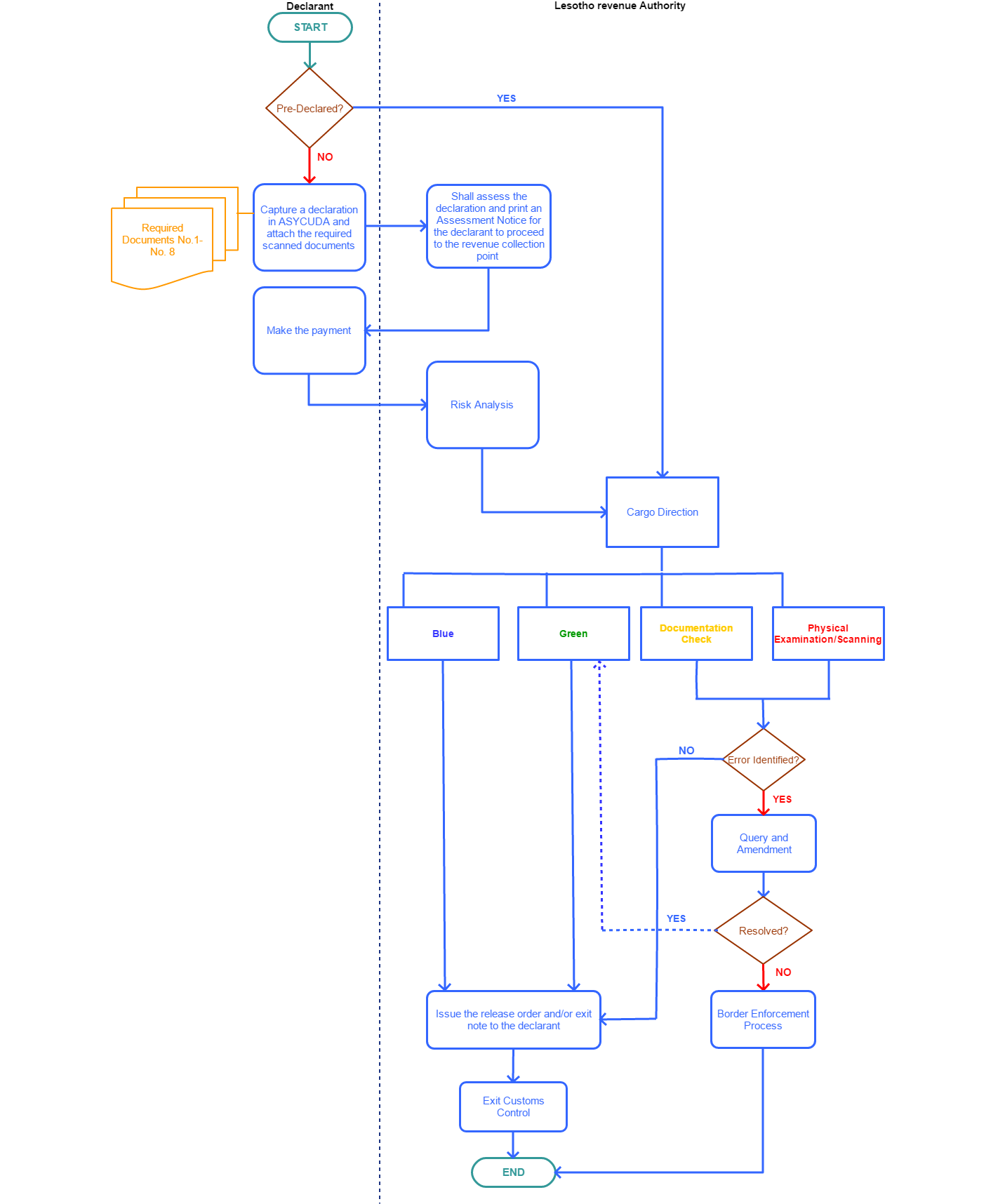

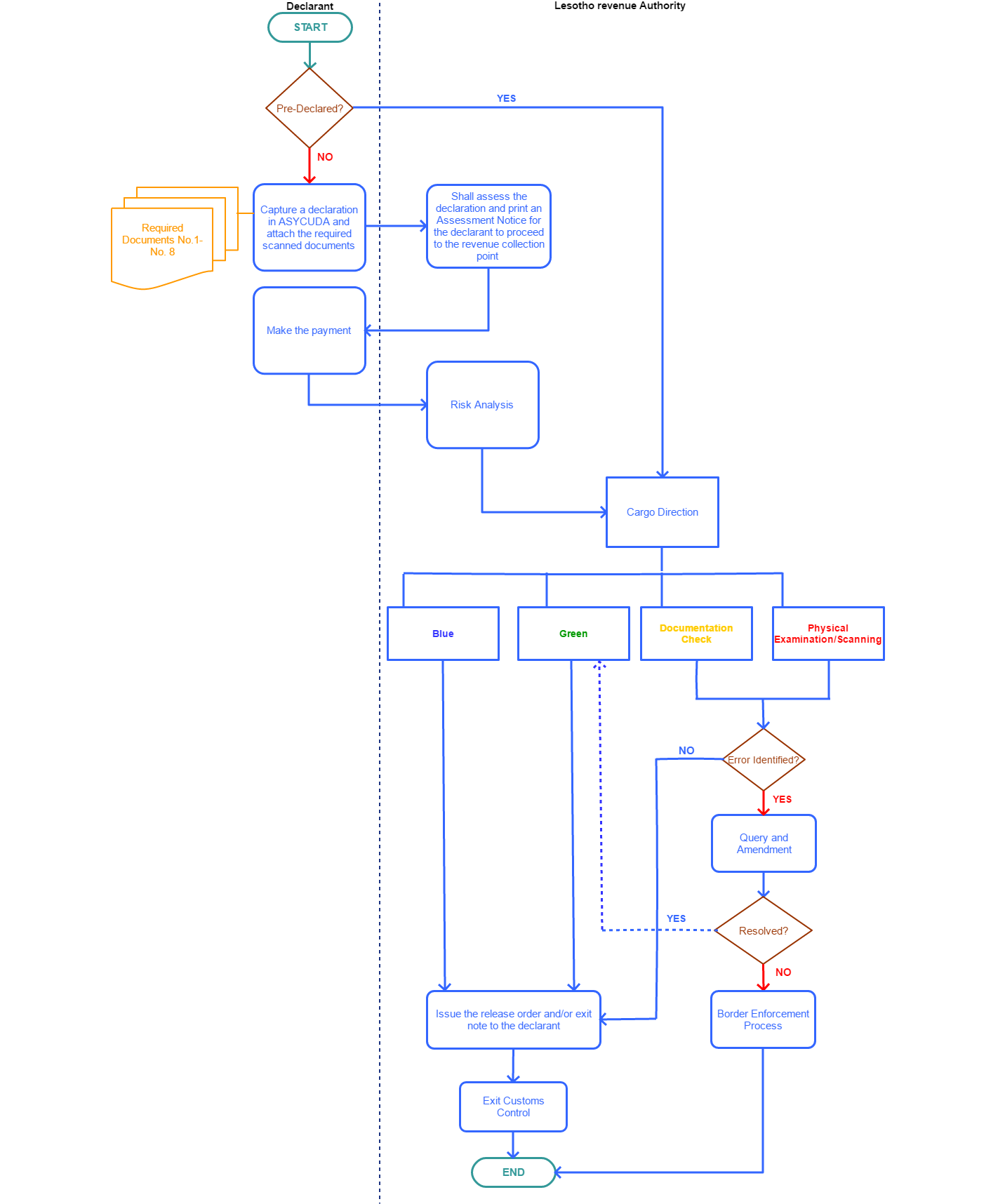

Process Steps

|

Step1

|

Capture and assess a declaration in ASYCUDA and attach the required scanned documents to the declaration taking special care to choose the correct Customs regime

|

|

Step2

|

Customs Data Capture officer shall Assess the declaration and print an Assessment Notice for the declarant to proceed to the revenue collection point

|

|

Step3

|

The Declarant make the payment

|

|

Step4

|

Customs Officer advise the declarant whether the cargo is ready for release or if it’s being subjected to the risk management process

Where goods are to be subjected to physical examination or documentary check, advise the declarant which process step he should report to and the process under those respective sections will proceed as required.

|

| Step5 |

Export Release

Perform an export release document process in ASYCUDA and print a release order to allow goods to exit the country.

Endorse the release order and pass it on to the Declarant.

|

| Step6 |

Allow the declarant to Exit out of Customs control |

|

|---|

| Category | Procedures |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| Permanent Export for Intra-SACU goods | General | | Extra-SACU export goods are cleared at the One-Stop Business Facilitation Centre (OBFC) before they can be allowed for export. This implies that the declarant will have to declare the cargo through OBFC whose LRA Customs officers will process the declaration according to the relevant Customs standards. Once the process at OBFC is complete, the cargo will travel to the border under Customs control using a transit declaration called a T1. On arrival at the border, the officers will ascertain conformity to Customs standards and once satisfied allow the goods to exit. | In accordance with the provisions of the Customs and Excise Act No. 10 of 1982, as amended, all goods and services imported into or exported from Lesotho are subject to Customs control.

Upon entry into and exit out of Lesotho, an importer/exporter is required to make a written declaration of goods and services regardless of their value. All goods are subject to examination by the LRA Customs. The declaration is made using official a declaration form that is used and accepted in whole of the Southern African Customs Union (SACU)1 region. | Customs and Excise Act No. 10, 1982 | 31-12-9999 | Good |

117