View Procedure

| Procedure Name | Warehouse Declaration Process |

|---|

| Description |

|

Category

|

clearance

|

|

Responsible Agency

|

Name of Agency; Lesotho Revenue Authority

Address: Finance House Building, Kingsway Road, Maseru

Phone: 223 13796

Fax: 223 12091

Email: enquiries@lra.org.ls

Official Website: www.lra.org.ls

|

|

Legal base of the Procedure

|

Customs and Excise Act No. 10, 1982 |

|

Fee

|

|

Required Documents

|

No.

|

Type of information

|

Note

|

|

1

|

IM7 declaration

|

|

Pre-arrival information can be any of the following:

|

No.

|

Type of information

|

Note

|

|

1

|

Commercial documents from the Supplier which may include but not limited to Invoices, Transport documents, Parking lists etc..

|

Documents necessary for the Declaration

|

|

2.

|

Import permits or certificates from the Country of Export or Origin

|

|

3

|

Authority letter from Importer appointing a clearing agent to clear the goods on his behalf

|

|

4

|

Import permits for specific goods in accordance with the current Trade regulations, obtained from One-Stop Business Facilitation Centre (OBFC) or the various relevant Government Ministries

|

|

5

|

Rebate and Exemption certificates from OBFC

|

If applicable

|

|

6

|

Manifests from Aircraft and other means of transport reporting arrival to Customs at a port of entry

|

|

|

7

|

Advance declaration data from other Customs administrations

|

|

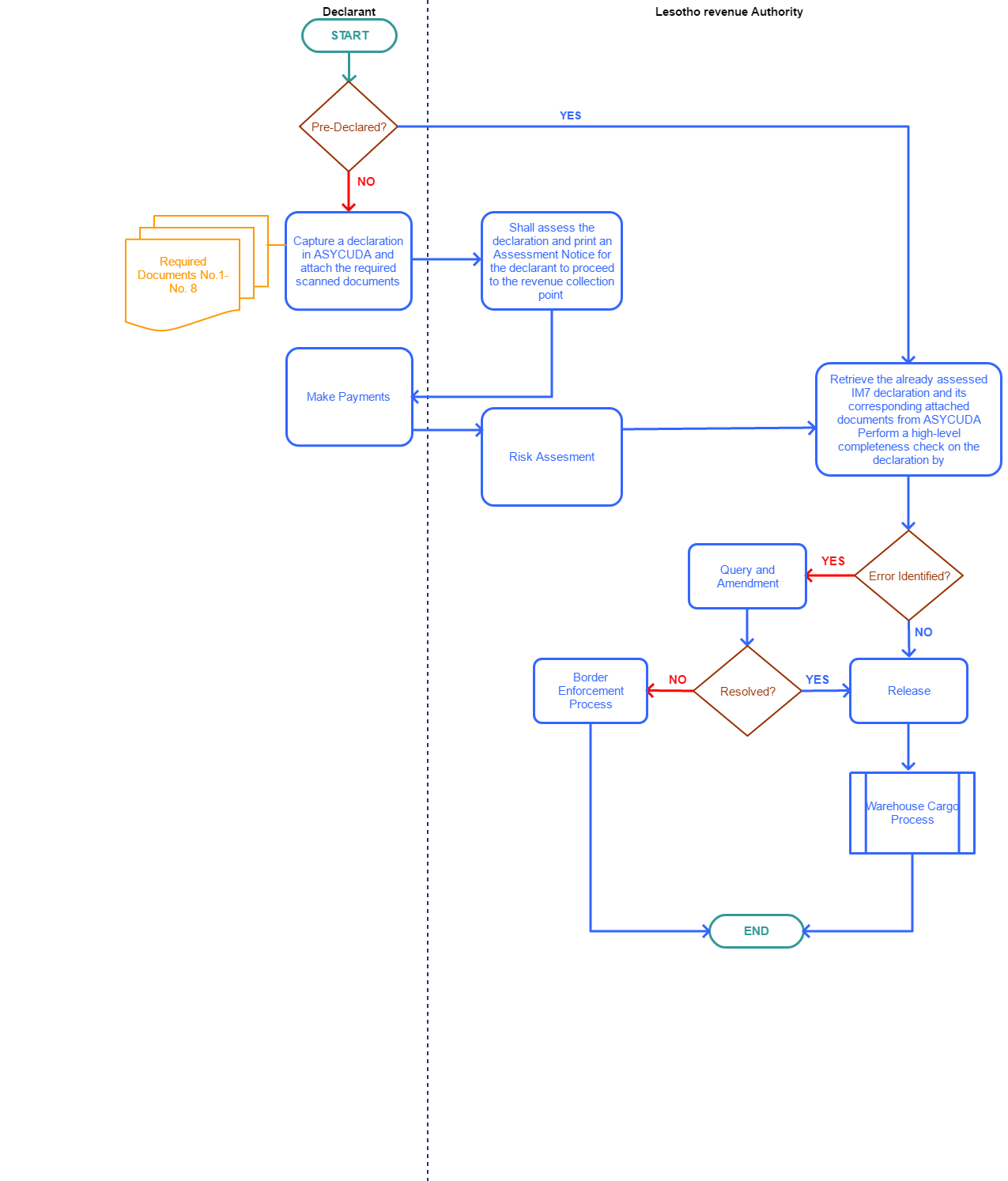

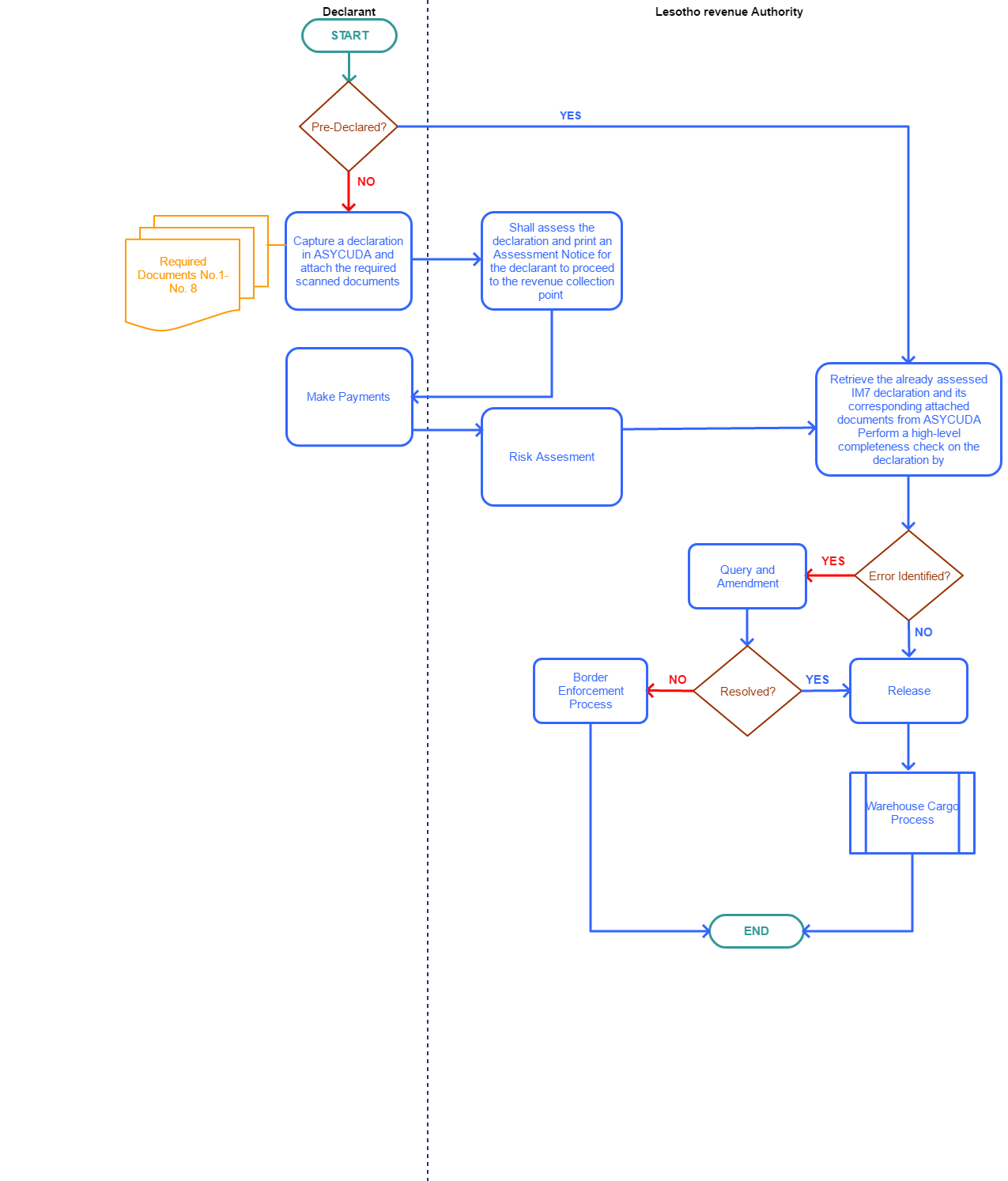

Process Steps

|

Step1

|

Declarant shall sapture and assess a declaration in ASYCUDA and attach the required scanned documents to the declaration taking special care to choose the correct Customs regime

|

|

Step2

|

Customs Data Capture officer shall Assess the declaration and print an Assessment Notice for the declarant to proceed to the revenue collection point

|

|

Step3

|

The Declarant make the payment

|

| Step4 |

Retrieve the already assessed IM7 declaration and its corresponding attached documents from ASYCUDA

Perform a high-level completeness check on the declaration by;

- Confirming that all relevant documents are attached. These documents may include the relevant commercial documents, transport documents, permits, certificates of origin and health for specific products and so on.

- Confirming that all mandatory boxes on the SAD are filled with valid information

Where not satisfied with the declaration, issue a query notification requesting the declarant to provide or confirm the necessary information. When the query is resolved, the Customs officer may amend the declaration and subject it to further processing

|

|

Step5

|

Where satisfied with the declaration, the officer shall notify the relevant officers in clearance and inspection to process the declarations accordingly

|

|

Step6

|

Release

The officer shall:

Generate and print a release order for verified documents and/or goods inspected

Endorse the release order and pass it on to the Declarant to allow entry.

|

|

|---|

| Category | Procedures |

|---|

The following form/s are used in this procedure

This procedure applies to the following measures

| Name | Measure Type | Agency | Description | Comments | Legal Document | Validity To | Measure Class |

| Warehouse Declaration Process | General | | Goods maybe warehoused at the State Warehouse or at Private warehouses (also known as Rebate stores) usually belonging to Manufacturers or at Public warehouses which have been licenced by Customs to hold goods for the public under the responsibility of the Public warehouse owner. | It is therefore expected that before goods can be physically offloaded into any of the warehouse types stated above, the declarant will declare these goods to Customs and obtain approval to warehouse his goods under Customs control. | Customs and Excise Act No. 10, 1982 | 31-12-9999 | Good |

119